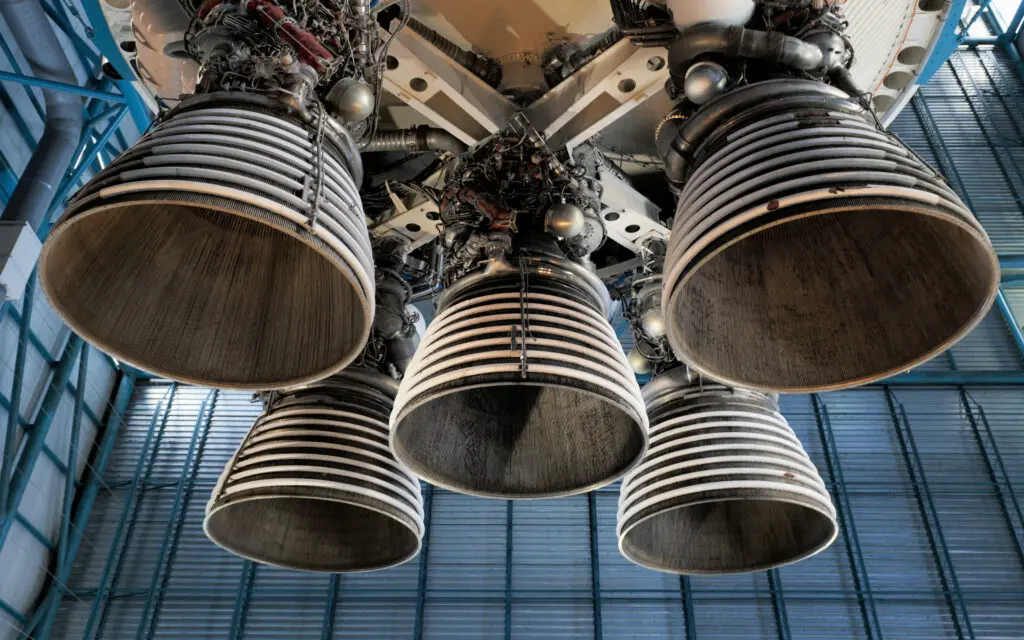

Aviation

We maintain a safe foundation so you can fly.

We’re taking on the challenges of an increasingly complex future in partnership with our clients. Explore our deep-rooted experience and expertise across a range of specialisms.

We maintain a safe foundation so you can fly.

When things get complex, we make insurance easy.

We understand what’s at stake in a high-risk industry.

We’re experts in technology, cyber and media liability.

We customise solutions to each type of energy.

We’re experts in protecting high-value items.

We’re with you at every stage of the journey.

We believe in productive relationships.

We understand the intricacies of property.

Our innovation and experience can help shape your tomorrow.

Our progressive approach is the future of reinsurance.

A dedicated team providing specialist risk consultancy, broking and risk management services to all stakeholders in the space industry.

Our mission is to be your dedicated partner and access to the London Insurance Market.