Price Forbes has always been about making history. Two years ago, we introduced a tailored insurance product designed to support real estate investment managers in protecting themselves, their property companies, property managers and portfolios. As we embark on its third anniversary, our bespoke Real Estate Investment Management insurance (REIM) wording solution continues to provide clients with a comprehensive and forward-thinking approach to coverage efficiency and risk management strategies.

The Grenfell Tower tragedy was a turning point for the industry, prompting a review into building regulations resulting in heightened safety measures and regulatory scrutiny. We responded by designing a sector-specific insurance solution that addressed the evolving risk landscape. Instead of fragmented coverage through the purchasing of multiple insurance policies, we created a unified policy that built an efficient and comprehensive insurance solution.

At the heart of this solution lies our bespoke REIM wording. Unlike generic policies, it is designed to reflect the specific needs of our real estate investment managers. By consolidating multiple lines of insurances, outlined below, into a single policy, we reduce coverage gaps, streamline protection whilst also delivering cost savings to our clients. This approach ensures that every stage of the investment lifecycle, from creation and acquisition to disposal and management, is protected.

Our bespoke REIM wording’s coverage clauses include Professional Liability (PI), Directors & Officers (D&O), Fraud/Crime, Entity Employment Practices Liability (EPL) for:

PI supports fund and fund managers, property companies, property managers, and development managers against claims of negligence, mismanagement, or breach of duty and regulatory investigations. This may include situations such as failing to properly maintain a property, which could result in damage or safety hazards. It can also cover failures to conduct proper due diligence before making investments, resulting in losses for the fund and their investors.

D&O provides protection for all directors and officers across the investment lifecycle in relation to fiduciary duties, disclosure obligations, and regulatory compliance. For example, directors may be exposed if the company does not properly manage tenant security deposits in accordance with the local law or claims that can be brought against directors by investors for improper disclosure to regulatory authorities.

Fraud/crime coverage provides protection to the company in respect of financial losses caused by fraudulent or criminal events, such as internal crime, external crime (fraud and counterfeiting) and electronic crime. It can provide coverage for the parent company and its subsidiaries and investment entities or funds, including those created or acquired during the policy period.

Entity EPL goes beyond standard D&O, covering discrimination, wrongful dismissal, and employment-related misrepresentation across all entities and employees.

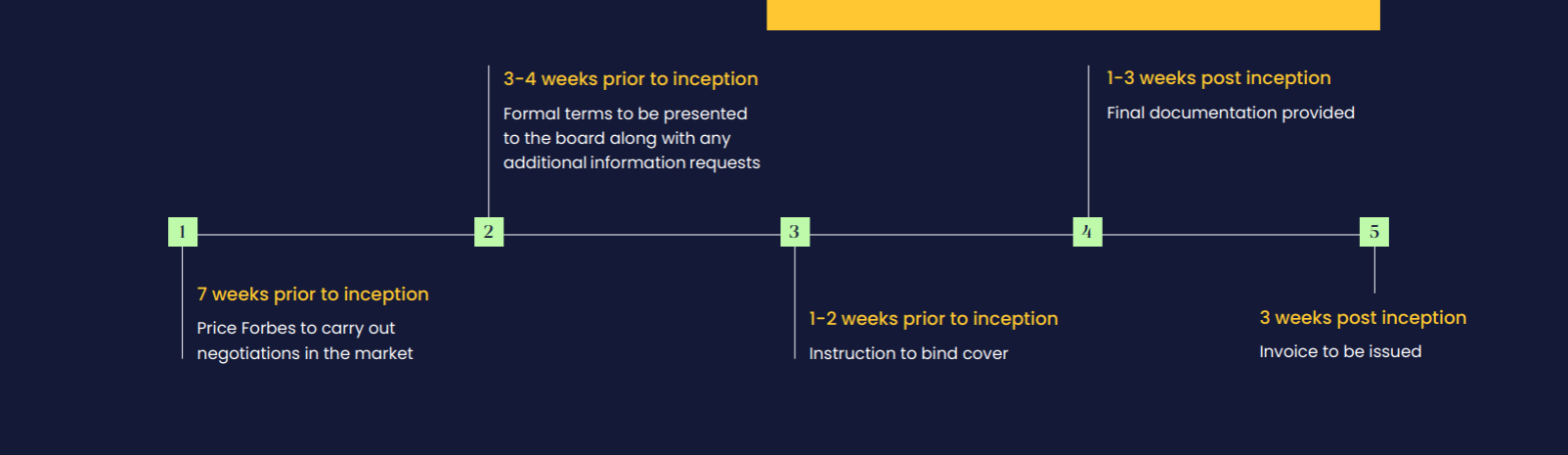

Securing this coverage is not a one-size-fits-all exercise. Our process practice overview ensures every placement is tailored, with clear stages from market negotiations to inception through to binding cover and final documentation. This structured yet flexible approach reflects our commitment to operational excellence and client transparency.

Our clients oversee a complex journey: creation, acquisition, due diligence, asset management, portfolio optimisation, and property management or disposal. Our solution is designed to provide coverage across these stages. Whether it’s claims of negligence during due diligence, disputes arising from tenant management, or risks tied to portfolio diversification, our wording ensures coverage throughout the lifecycle.

As part of The Ardonagh Group, Price Forbes leverages scale, expertise, and insurer relationships to deliver solutions that are tailored for the real estate sector. Our clients have already seen the benefits through fewer policies, reduced costs, and enhanced peace of mind. Our REIM insurance solution was one of the first of its kind in the market, and three years on, it remains a leading option for managers seeking comprehensive, sector-specific coverage.

For more information on how Price Forbes can support your real estate investment management needs, please contact our team.

Our insurance experts are always on hand to talk about ways we can join forces to take on the future.